Dave Welch (@OraVBCA), CTO & Chief Evangelist

New Class Action Filings Against Oracle’s Executive Leadership

There are two recent and related class action lawsuits against Oracle’s executive leadership. The filings are substantial in their allegations of both consistent public misrepresentation of Oracle’s cloud revenue and installed customer base, and Oracle’s audit and sales tactics to inflate its cloud revenue numbers. I believe the allegations and quotes of public material in these lawsuits should be considered by customers assessing their Oracle license map, dealing with a past or current Oracle audit, and/or considering expanding their relationship with Oracle.

Pam Fulmer of Tactical Law Group analyzed the Providence filing in her 7 May 2019 blog post. House of Brick CEO Nathan Biggs discussed both filings in his 14 May blog post.

For your convenience, the filings may be downloaded here:

- Securities Class Complaint – 107 pages

- City of Providence filing – 115 pages

The 8 March 2019 Securities Class Complaint filing is an amendment and expansion of the City of Sunrise Florida Firefighters Pension Fund 10 August 2018 class action (see my 15 August 2018 blog post here). The Securities Class Complaint expands the class and sports a new, court-appointed primary plaintiff – Union Asset Management Holding AG (informal name Union Investment) out of Germany. The Securities Class Complaint also expands over the Sunrise filing through the introduction of detailed allegations on the part of nine former Oracle employees from divisions and geographies all over the globe.

The Providence filing begins with this statement:

“Plaintiff City of Providence (“Plaintiff”) … brings this action derivatively on behalf of Oracle Corporation …”

Intriguing. Here’s the Providence filing’s rationale:

¶ 8: “The Securities Class Complaint seeks to recover damages on behalf of investors who purchased or sold Oracle securities during the Relevant Period. This action, on the other hand, seeks to redress harm to the Company arising from the federal securities class action, primarily because Oracle is not a member of the class as defined in the Securities Class Complaint.” (See also ¶ 247 – 248, 253, 353-354, 356 – 357, 360, 363 – 365.)

Warning: these filings are page turners. For those of us who spend our days dealing with Oracle overreach and misdirection, the content of these filings is quite compelling. The Providence filing references the Securities Class Complaint and integrates most of it through copy, often with minimal, if any, rewording. For that reason, I recommend:

- A full read of the Securities Class Complaint

- A selective read of the Providence complaint using the guidance I provide below

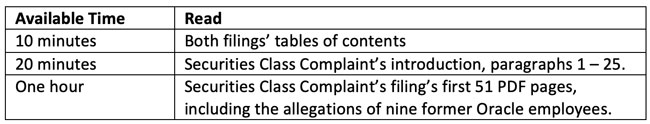

If your time is limited, may I suggest the following:

All appearances are that Mars came out well in its 23 October 2015 filing. Mars’ filing was based on two causes of action, one being Oracle’s attempt to redefine “installed” in hypervisor-enabled environments, and the other being Oracle’s attempt to expansively redefine what constitutes a business intelligence application user. I think it significant that neither Mars nor its two causes of action are even mentioned in either the Securities Class Complaint or the Providence filing.

Quoting from Nathan’s 14 March 2019 blog post:

“Oracle employees validate what we (and our customers) already know. With the hundreds of clients that we have assisted with Oracle license compliance validation, optimization, and audit defense services, we have become accustomed to the shenanigans that Oracle’s sales and audit LMS teams display around the globe on a regular and predictable basis.”

Three things in the allegations, and quotes of published material, were news to me (or surprised me). I mention two of them here:

- Securities Class Complaint: the allegation that Oracle had internally booked cloud items not shown anywhere on customer-facing ordering documents.

- Providence filing: the allegation that Oracle is effectively under the sole control of Ellison.

Other Innovations in the Providence Filing

Beyond the Securities Class Complaint, Providence’s allegations include, but are not limited to, the following issues.

¶ 3: $14 billion in stock repurchases within less than two years, the allegation being that the repurchase was intended to mask the company’s stagnant growth. (See also ¶ 74-80, 157, 242 – 244, 255, 259, 263, 267.) Stock repurchases, are of course, standard practice among publicly traded companies. It will be up to the shareholders and the court to determine whether this was done egregiously to hide consistently bad performance, as alleged in the filings.

¶ 167 – 171: The allegation that the artificial inflation of the performance of Oracle’s cloud business greased the skids for the NetSuite purchase. The idea is that Oracle was compelled to pay too much. Netsuite isn’t mentioned in the Securities Class Complaint other than in a footnote reference.

The allegation that Ellison was the absolute control person over Oracle:

¶ 347: “During his tenure as an officer and/or Chairman of the Board, as well as the Company’s visionary founder with absolute control over the Board and the Company, Defendant Ellison was a controlling person of all Officer Defendants within the meaning of Section 20(a) of the Exchange Act. By reason of his absolute control, Defendant Ellison had the power and authority to direct the management and activities of the other Officer Defendants, to hire and fire the other Officer Defendants at whim, and to cause the other Officer Defendants to engage in the wrongful conduct complained of herein. Defendant Ellison was able to and did control, directly or indirectly, the content of the public statements made by all other Officer Defendants during the Relevant Period, including the materially misleading financial statements, thereby causing the dissemination of the false and misleading statements and omissions of material facts as alleged herein.”

¶ 348: “In his capacity as founder, visionary, controlling stockholder, senior executive, and Chairman of the Board of Oracle, Defendant Ellison had direct involvement in and oversight over the day-to-day operations of the Officer Defendants and the Company’s employees, who would not act unless Defendant Ellison agreed with their course of conduct. Specifically, Defendant Ellison is, and was at all relevant times, Oracle’s Chief Technology Officer, Chairman of the Board, founder, visionary leader, and controlling stockholder. As the absolute control person of Oracle, Defendant Ellison has personally hired and overseen the work of the Officer Defendants in carrying out his vision for the Company as well as threatened to take or has taken retaliatory actions against any employee who strays from his leadership.”

(See additional detail on this allegation in ¶ 281 – 294.)

¶ 158, 218 – 220 mentions old news: the Oracle board’s compensation committee’s rework of the executive team’s compensation to be incentivized based on stock price and cloud revenue performance.

Providence’s Prayer for Relief includes these additional items:

“B: Determining and awarding Oracle the damages sustained by it as a result of the violations set forth above from each Officer Defendant, joint and severally, together with prejudgment and post-judgment interest thereon;

C: Declaring that Defendants have breached their fiduciary duties to Oracle;

D: Directing Oracle to take all necessary actions to reform and improve its corporate governance and internal procedures to comply with applicable laws and to protect the Company and its stockholders from a repeat of the damaging events described herein;”

Parting Thoughts

I tip my hat to the three organizations named in the Securities Class Complaint (¶ 163) as having refused to play Oracle’s cloud revenue game:

- Toy-maker Mattel

- Guardian Life Insurance

- Southern California Edison

We’ve worked with organizations governed by Oracle License and Services Agreements (OLSA) that haven’t seen any substantial harm in accommodating Oracle’s insistence in introducing its Oracle Master Agreement (OMA) into incremental sales rather than the customers’ legacy agreements. However, these two lawsuits allege good reason to stick with the OLSA. Unlike the OMA, the OLSA doesn’t contain Schedule C – Cloud Services, providing one more obstacle to becoming an unwitting enabler in Oracle’s self-serving games.

Of course these lawsuits bring to mind the 1 June 2016 filing by plaintiff Blackburn alleging Oracle’s cooking of the cloud revenue books for purposes of manipulating stock price. Shortly thereafter, two class actions were filed against Oracle based on the Blackburn filing. (Both class action plaintiffs voluntarily dismissed their actions out of court. Oracle settled out of court with Blackburn 8 February 2017.) In contrast, public entities are involved as plaintiffs in both of these new filings. I would imagine that increases the odds that the existence and detail of any out-of-court settlements may become subject to Release of Records/Freedom of Information statutes, and therefore would be made public.

The independent allegations of two former employees that 90% of the so-called “Dead on Arrival” or “DOA” customers didn’t renew (Securities Class Complaint ¶ 125) put emphasis behind a couple of Oracle Cloud blog posts (here and here) in which I called into question Oracle Cloud’s readiness and competitive position. The allegations of Oracle’s systemic, shameless misrepresentations may give pause to organizations considering including Oracle in RFP initiatives (see my 27 January 2017 blog post on the CoverOregon litigation between the State of Oregon and Oracle).

In answer to my 15 August 2018 post title Will This Latest Suit Against Oracle Ever See a Court Hearing?, it would appear the suit saw at least one hearing before Judge Freeman, which led to what is now the Securities Class Complaint.

The allegations in these two lawsuits may indicate that Oracle customers have more leverage than they realize. I note that Oracle moved to dismiss the original City of Sunrise Firefighters Pension Fund filing (See Tactical Law Group’s 26 April 2019 blog post) rather than happily argue the case’s merits in court as a signal to the world that Oracle intended to rid itself of the nuisance of such lawsuits.

The allegations also emphasize the wisdom of getting expert advice rather than attempting to go it alone. Let House of Brick assist you with your Oracle licensing needs.