Dave Welch (@OraVBCA), CTO & Chief Evangelist

Tactical Law Group’s Pam Fulmer does the non-attorneys among us who work in the Oracle licensing industry a favor by keeping us abreast of legal cases that interest Oracle users. This is handy as we don’t have case law databases. Recent posts in Pam’s Oracle blog:

- Oracle Hit with New Lawsuit for Fraud, Negligent Misrepresentation, Breach of Contract, Breach of Warranty and Other Claims Involving its ERP and Cloud Offerings (22 February 2019)

- Oracle and Its Partners Sued for Negligent Misrepresentation and Breach of Contract Over Oracle Cloud Software Product (7 January 2019)

Yet, as I look at equities analysts’ discussions, I see nary a mention of Oracle’s legal problems, but rather an overall bullish outlook for ORCL. Examples include:

- Post Analyst: https://postanalyst.com/2019/02/04/analysts-refreshing-their-ratings-on-oracle-corporation-orcl-amazon-com-inc-amzn/

- RNS Daily: https://www.rnsdaily.com/2019/02/22/analysts-clamor-over-valuing-oracle-corporation-orcl/

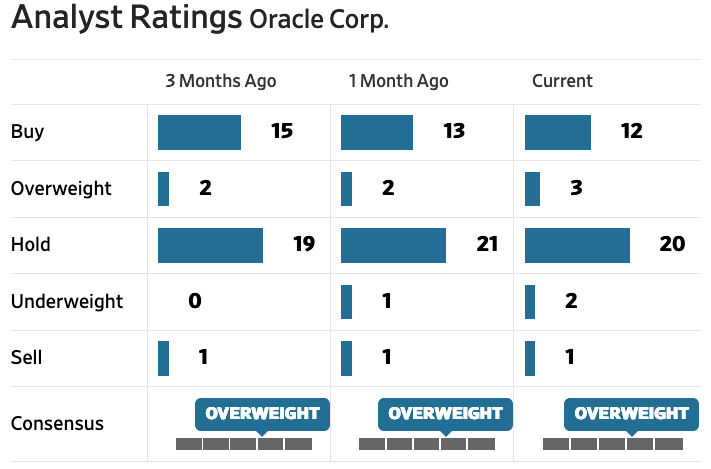

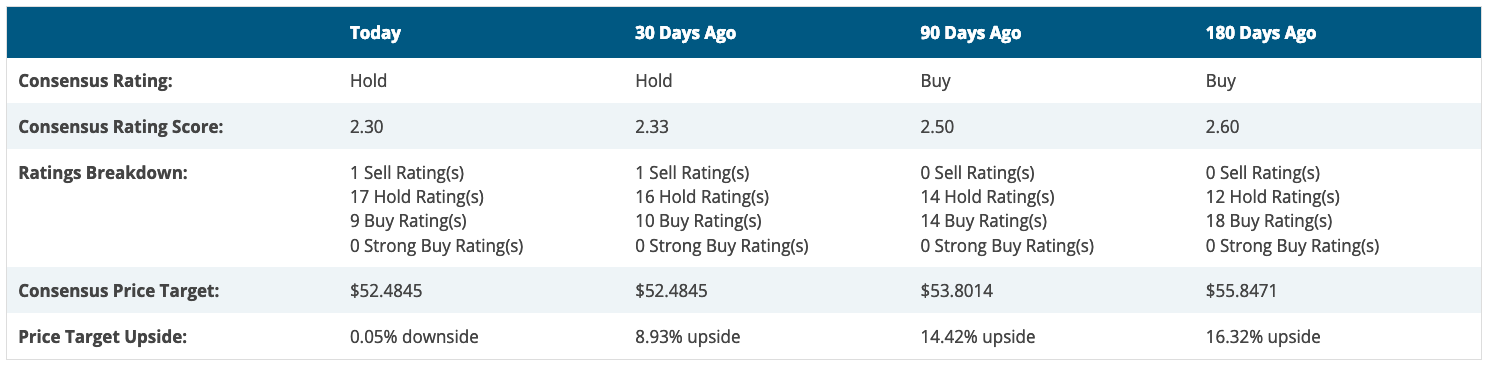

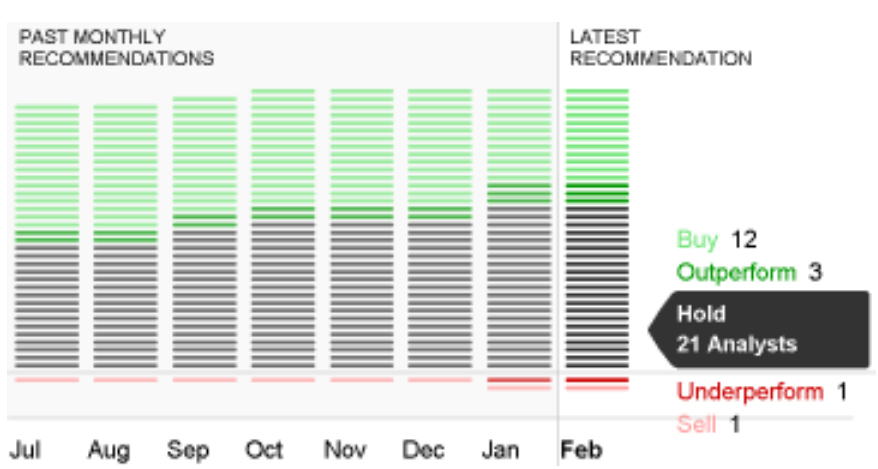

It may be that such issues pale in the larger picture of corporate finance and valuation. The Wall Street Journal, MarketBeat, and CNN Business show analysts’ overall shifts on Oracle over time.

Wall Street Journal [1]:

MarketBeat[2]:

CNN Business[3]:

On the other hand, taking the hypothetic that there is substance to most, if not all, of the accusations of misrepresentation, it may be that eventually Oracle will reach a threshold where the accusations find their way into the analysts’ discussions. Beyond that, the point may arrive when such discussions reflect the cumulative negative impact of such legal problems on Oracle’s market position and valuation.

[1] Source: https://quotes.wsj.com/ORCL/research-ratings

[2] Source: https://www.marketbeat.com/stocks/NYSE/ORCL/price-target/

[3] Source: https://money.cnn.com/quote/forecast/forecast.html?symb=ORCL