Dave Welch (@OraVBCA), CTO and Chief Evangelist

This blog post is a recent interaction with a customer threading with me on Oracle Cloud.

Are there any Oracle licensing considerations beyond the user seat license scheme for ERP Cloud?

Yes, Oracle’s operational readiness. I recommend my blog post “Oracle’s Determined to Get You in its Cloud. You Game?” There are many entities, including some in our customer base, which have been compelled to purchase cloud credits for the purpose of getting a deal on some other on-prem products they were interested in. Very few do anything other than leave the cloud credits on the shelf, and I can count those I’m aware of on the fingers of one hand.

I am not at all compelled by Ellison’s announcement a month ago about how he’s now got a bigger, better deal and will best AWS’ performance. He’d have to make it free to compete with the price of all the cloud credits sitting on licensee’s shelves. Even with the software costs sunk, these licensees are not implementing their Oracle Cloud credits. I recommend a web search for AWS’ rebuttal to Ellison’s performance claim. Oracle has not produced an implemented market share anywhere near the scale that induced VMware to strike a deal with AWS.

Are you aware of clients who have moved to Oracle ERP Cloud, and if so, are they happy with the experience?

I am not aware of any who are there, only those considering it. However, I’m cautioning them with the same provisos I’m providing you. People should be very leery of the fact that the entire message at Oracle Open World was focused on cloud services. That push should be no surprise given Oracle’s massive re-org of its sales force in June. Yes, SaaS is absolutely taking the world by storm and for good reason. That said, Oracle has disqualified itself for SaaS consideration short of what I would think would have to be a minimum year-plus observation of other referenceable customers to prove the thing out.

For a recommendation on how not to do an Oracle ERP implementation (on-prem or otherwise), have a look at my piece on the CoverOregon boondoggle between the State of Oregon and Oracle. My read of the State’s allegations before the unpleasantries were settled is that Oracle was willing to make just about any representation in order to make the sale.

Also consider that there are too many cloud providers that contractually prohibit probing or scanning into their environment from the outside, or probing or scanning laterally within the environment. I’m sorry, but I don’t care how good your security power points and certifications are. Of course I have no interest in mounting a denial-of-service attack, but if I can’t scan, I have no security. The guys without contracts with these cloud providers are scanning their environment. Here’s how the restriction reads in the Oracle Cloud Services Agreement:

4. OWNERSHIP AND RESTRICTIONS

…

4.2 You may not, and may not cause or permit others to:

…

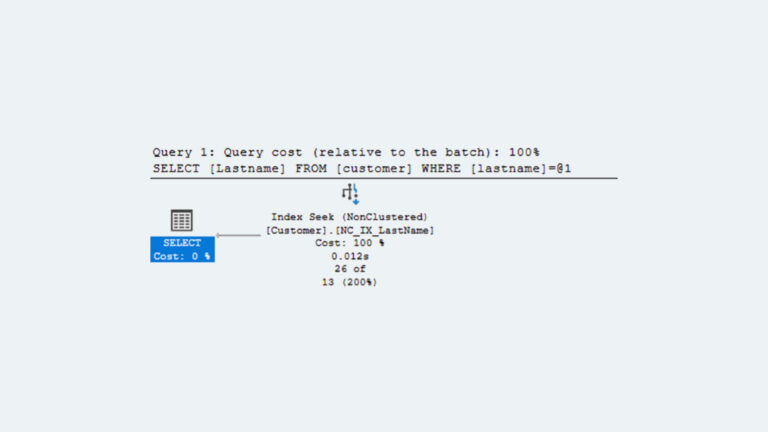

d) perform or disclose any benchmark or performance tests of the Services, including the Oracle Programs; e) perform or disclose any of the following security testing of the Services Environment or associated infrastructure: network discovery, port and service identification, vulnerability scanning, password cracking, remote access testing, or penetration testing; …

In addition, I know I would be dissatisfied with the Oracle Cloud experience because Oracle’s got the wrong hypervisor and surrounding tools. If I can’t clone entire pre-production ERP systems stacks in minutes (no matter how large the storage footprint) in a cloud enabled environment with world-leading vRealize Automation Center, I am locked out from cramming more features into a release with a better QA, fewer people involved, and a compressed release calendar. That reduces my organization’s ability to compete. I also can’t leverage world-leading Site Recovery Manager for fourth-generation ~100% reliable DR. I could go on. I understand I’m discussing tooling that is independent of the application stack. But if my SaaS provider can’t address these operational requirements, I’m sticking with application software that my organization installs itself on-prem or in an IaaS cloud where such tools are allowed.

Have you seen Oracle to be price competitive for their SaaS offerings, in order to make the sale?

Even if Oracle had the tooling, SaaS customer base, and operational track record, the biggest costs of doing business with Oracle are indirect. For example, an organization’s Oracle audit experience must be taken as predictive of similar (hard and soft) costs that will manifest themselves in a protracted relationship with an entity that I believe has significant integrity issues.

Insights on Oracle’s Status in the Industry

It seems that every time I turn around, I am informed of another scaled customer who has sworn off implementing any net new projects on Oracle. The decision is made no matter the costs involved in retraining, re-tooling, and re-licensing, as well as any backlash for disappointing the business user base with sliding project plans. My involvement in a business line that shouldn’t exist—Oracle audit defense—led me over a year ago to conclude that if I were a CIO or CTO in an end user organization, I would be advocating the same.